UK’s National Debt Hits Highest Level Since 1962, Exceeding Pandemic Peak

Fiona Nanna, ForeMedia News

7 minutes read. Updated 5:07PM GMT Fri, 19July, 2024

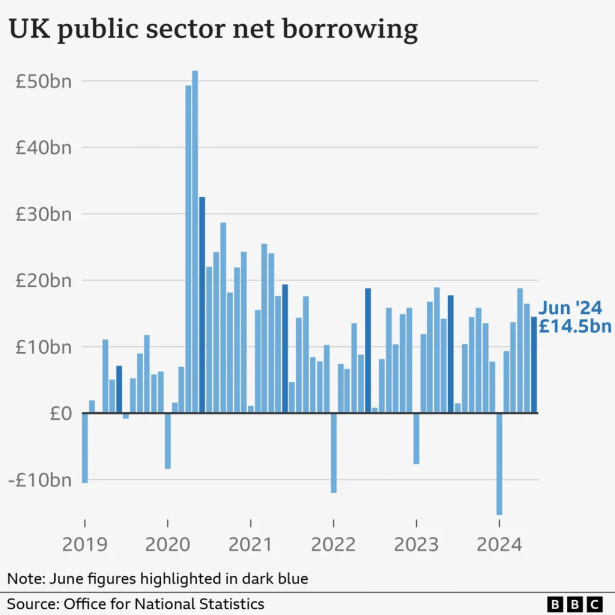

The United Kingdom is grappling with its highest national debt levels since 1962, according to the latest figures released by the Office for National Statistics (ONS). As of June, the total stock of government debt stood at 99.5% of the UK’s economic value, surpassing previous peaks recorded during the coronavirus pandemic. This marks a significant milestone in the country’s fiscal history.

The ONS data reveals that government borrowing in June exceeded expectations, signaling a continuing strain on public finances. The Chancellor of the Exchequer, Rachel Reeves, is anticipated to address the state of the public finances with a statement by the end of the month.

Government debt encompasses the cumulative amount of money owed by the UK government, accrued over years of borrowing. In contrast, borrowing refers to the gap between public sector spending and revenue from taxes during a specific period.

Chief Secretary to the Treasury, Darren Jones, characterized the current debt levels as indicative of the “worst economic inheritance” since World War II. Despite June’s borrowing figure of £14.5 billion being the lowest for that month in five years—thanks to decreased interest costs due to falling inflation—it remains above the forecasts made by economists.

With increased demands for public spending and commitments not to raise income tax, corporation tax, or VAT rates, many economists predict a rise in borrowing. Dennis Tatarkov, Senior Economist at KPMG UK, commented on the situation, stating, “The new Chancellor faces the daunting task of balancing the new government’s spending agenda with the need to maintain sustainable public finances. The choice between further borrowing or significantly raising taxes will be a challenging one if current spending levels are to be upheld.”

In related economic news, the ONS also reported a more significant-than-expected drop in retail sales last month. Retail volumes fell by 1.2% in June, following robust growth in May. Non-food retailers, including clothing stores and department stores, experienced the most significant decline, with sales dropping by 2.1%. The ONS attributed this downturn to factors such as cold weather, election-related uncertainties, and reduced consumer footfall.

For more detailed updates on the UK economy and government fiscal policies, visit the Office for National Statistics and follow the latest news on BBC News.