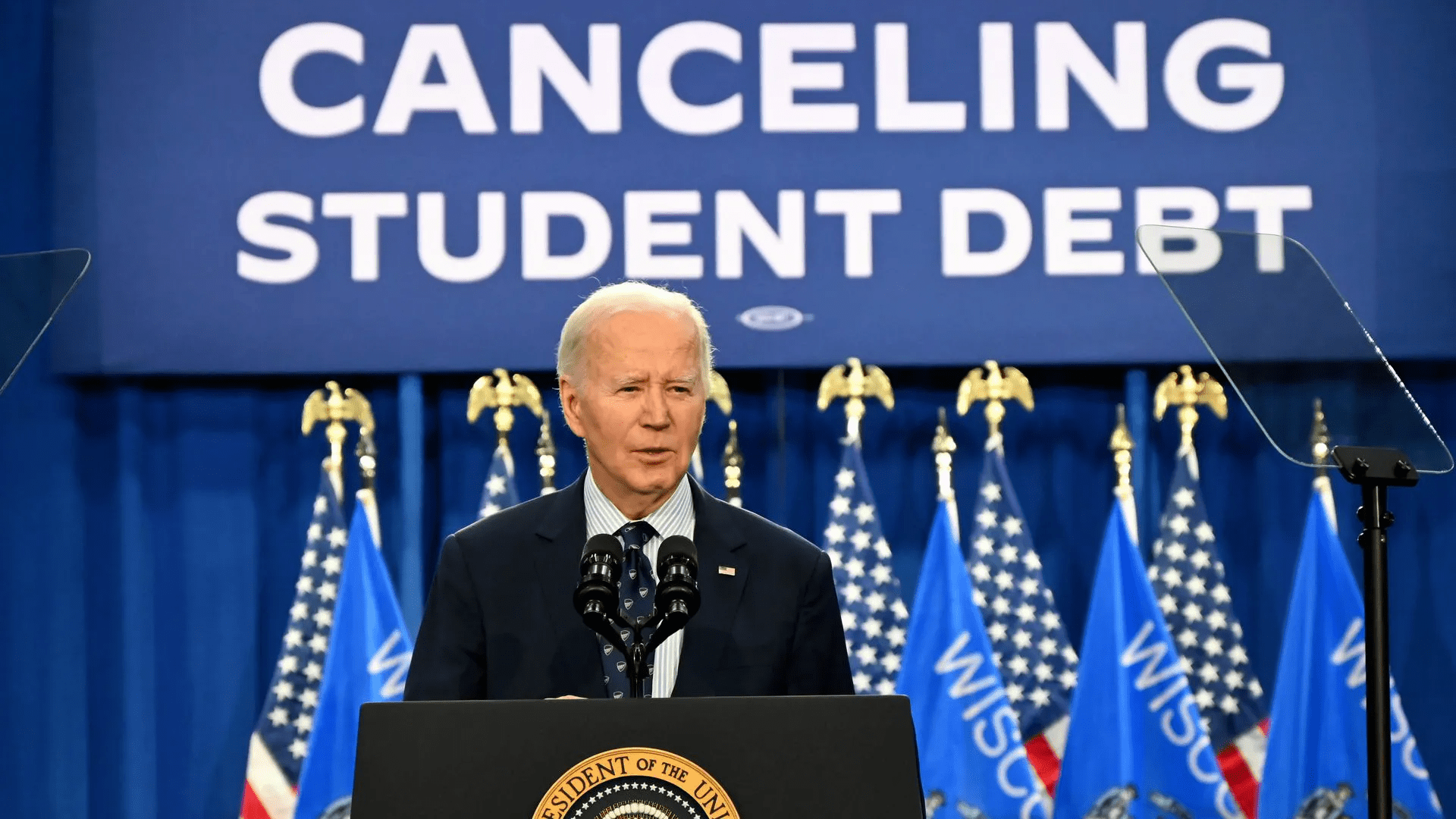

U.S. Supreme Court Rejects Biden Administration’s Request to Reinstate $475 Billion Student Debt Relief Plan Blocked by 8th and 10th U.S. Circuit Courts of Appeals

Fiona Nanna, ForeMedia News

4 minutes read. Updated 2:57AM GMT Thurs, 29August, 2024

The U.S. Supreme Court on Wednesday rejected the Biden administration’s urgent request to reinstate its latest multibillion-dollar student debt relief plan, leaving millions of borrowers uncertain about their financial futures as legal challenges continue in lower courts. The administration’s plan, which aimed to reduce monthly payments and streamline loan cancellations, remains stalled following an earlier block by the 8th U.S. Circuit Court of Appeals.

In a brief, unsigned order, the Supreme Court stated it anticipates the appeals court to make a comprehensive decision on the matter “with appropriate dispatch.” This ruling has prolonged the stalemate over a plan that could potentially impact millions of Americans burdened by student loan debt.

Administration’s Debt Relief Plan Faces Uphill Battle

The Biden administration’s proposal under the SAVE (Saving on a Valuable Education) plan aims to halve income-driven repayment rates from 10% to 5% of a borrower’s discretionary income and eliminate payments for those earning less than 225% of the federal poverty line—equivalent to $32,800 annually for a single person. However, cost estimates for the SAVE plan have been hotly contested. Republican-led states opposing the plan argue that it would cost $475 billion over the next decade, while the Biden administration has cited a more modest Congressional Budget Office estimate of $276 billion.

Two significant legal challenges to the SAVE plan are pending in federal courts. Earlier this year, judges in Kansas and Missouri issued rulings that blocked key components of the plan, although debt that had already been forgiven under the program was not impacted. The 10th U.S. Circuit Court of Appeals did allow a provision for lower monthly payments to proceed, but this was later blocked by the 8th Circuit, which halted the entire plan.

Supreme Court Declines to Intervene Early, Adding to Uncertainty

The Justice Department had urged the Supreme Court to intervene in the legal dispute over the SAVE plan, much like it had with the previous debt relief proposal. However, the justices opted against stepping in at this stage, leaving the resolution to the lower courts. “This is a recipe for chaos across the student loan system,” remarked Mike Pierce, executive director of the Student Borrower Protection Center, an advocacy organization. “No court has decided on the merits here, but despite all of that, borrowers are left in this limbo state where their rights don’t exist for them.”

Pierce noted that about eight million people were already enrolled in the SAVE program when the lower court’s order paused it. An additional 10 million are actively seeking options to make their monthly payments more manageable. The uncertainty around the plan has left many in a financial bind, unsure of what the future holds.

Conservative Voices Challenge Legitimacy of the Plan

Sheng Li, litigation counsel with the New Civil Liberties Alliance, a legal group backed by conservative donors, praised the Supreme Court’s decision to uphold the block. “There was no basis to lift the injunction because the Department of Education’s newest loan-cancellation program is just as unlawful as the one the Court struck down a year ago,” he said in a statement.

This recent setback marks another chapter in the contentious battle over student loan forgiveness in the United States. Last year, the Supreme Court’s conservative majority rejected a similar proposal that would have eliminated more than $400 billion in student loan debt. As legal battles continue, millions of Americans are left waiting for a clearer path forward.