Donald Trump Makes Final Decisions On China’s Big Companies

Donald Trump has taken a final swipe at China and its biggest companies, imposing more sanctions and investment bans in his last days of office.

Nine Chinese firms have been added to the Pentagon’s blacklist of alleged ties to the Chinese military, including phone maker Xiaomi.

Mr Trump has ramped up action against a host of companies he believes are a security threat in recent months.

China retaliated this week with a new law aimed at protecting its firms.

Over the last few months Mr Trump has targeted Chinese technology companies he believes share personal data with its government with TikTok, Huawei and WeChat caught in the crossfire.

His latest round of restrictions announced on Thursday affect, among others, China’s oil giant CNOOC and Xiaomi, which in November surpassed Apple to become the world’s third-biggest smartphone manufacturer.

The US Commerce Department accused CNOOC of harassing and threatening offshore oil and gas exploration and extraction in the South China Sea.

CNOOC, which is state-owned, acted as “a bully for the People’s Liberation Army to intimidate China’s neighbours” said Commerce Secretary Wilbur Ross.

CNOOC will now join a blacklist that requires firms to be granted a special licence before they can receive exports of high-tech items from US suppliers.

Xiaomi shares trading in the US dropped as much as 14% on Thursday while in Hong Kong the shares fell more than 11% on Friday.

Many believe this latest action is Mr Trump’s final swipe at Chinese companies before President-elect Joe Biden’s inauguration on 20 January.

However, Nicholas Turner, a lawyer at Steptoe & Johnson in Hong Kong, told the BBC “I think there might be one more. We are also watching for updates from the US Treasury Department.”

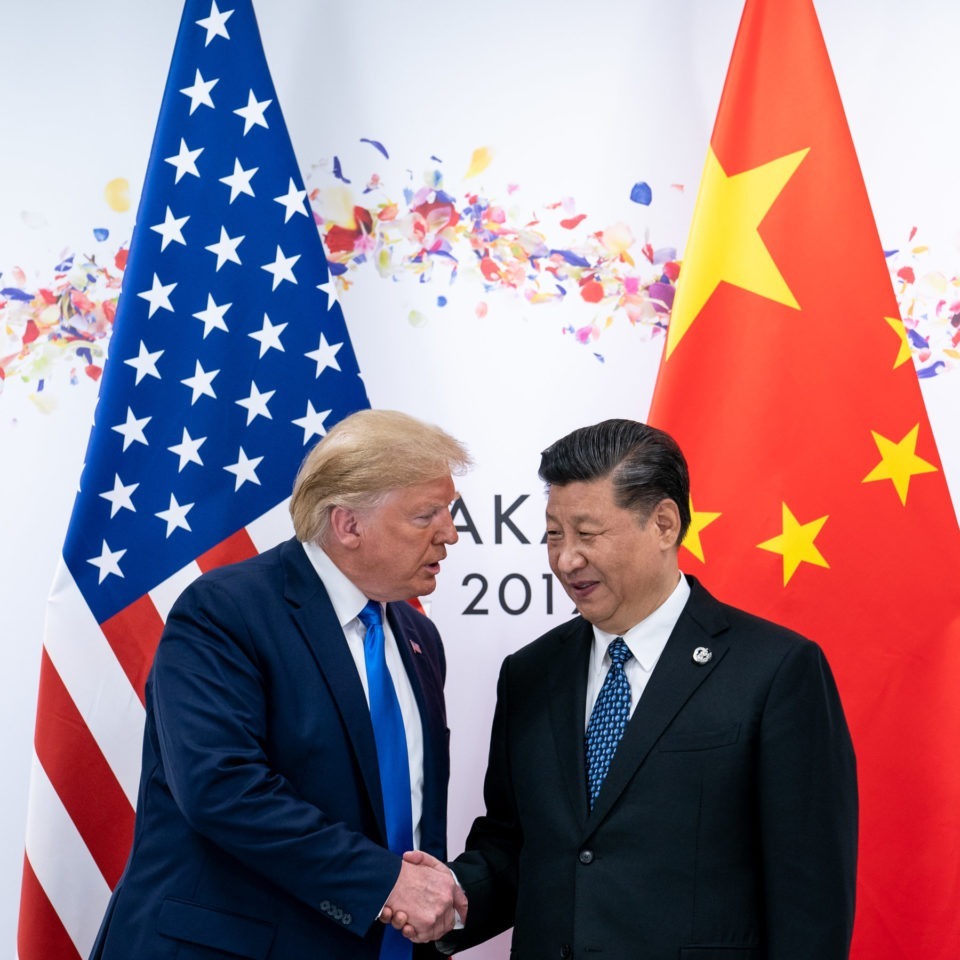

The US and China have been engulfed in a trade war since 2018 which has seen a range of tariffs slapped on imports of each other’s goods.

This trade war between the world’s two biggest economies has caused a peak loss of 245,000 US jobs, according to a study by Oxford Economics.

The study, commissioned by the US-China Business Council (USCBC), predicts that a significant decoupling could shrink US GDP by $1.6tn (£1.2tn) over the next five years.

“With China forecast to drive around one-third of global growth over the next decade, maintaining market access to China is increasingly essential for U.S. businesses’ global success,” the study said.