Venezuela’s Economic Crisis: How Oil Dependency and Recent Political Challenges Shape the Nation’s Future

Fiona Nanna, ForeMedia News

4 minutes read. Updated 9:31PM GMT Sun, 28July, 2024

Venezuela’s ongoing economic crisis is a central issue in this Sunday’s presidential election, with President Nicolás Maduro aiming to demonstrate progress after years of severe hardship. Despite recent efforts to lower the cost of living, Venezuela’s economic challenges remain substantial.

In February, Venezuela saw a significant reduction in hyperinflation that had peaked at over 400,000% annually in 2019. Currently, annual inflation stands around 50%, a notable improvement but still high by international standards. Maduro attributes this decline to his policies, asserting that they are effective. However, critics argue that these measures have done little to address the deep-rooted structural issues of Venezuela’s economy, particularly its heavy reliance on oil.

As highlighted by the US Council on Foreign Relations, oil has been both a boon and a bane for Venezuela since its discovery in the 1920s. The country’s overdependence on this sector has led to cycles of economic boom and bust. Opposition leaders, led by Edmundo González, are advocating for a change in leadership as a means to revitalize Venezuela’s economic prospects. According to Jason Tuvey, Deputy Chief Emerging Markets Economist at Capital Economics, an opposition victory could lead to the easing of US economic sanctions imposed after the controversial 2018 election, which would allow state-run oil company PDVSA to resume international oil sales and potentially improve the country’s economic situation.

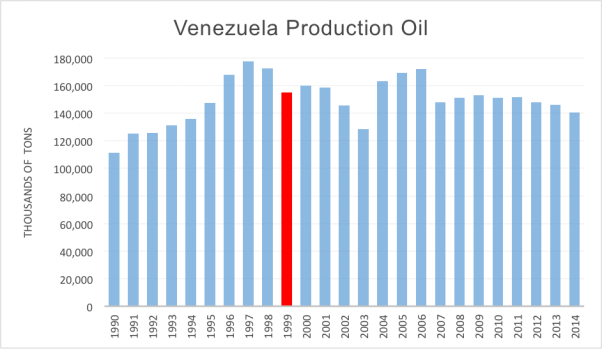

However, Tuvey warns that reversing Venezuela’s economic decline will be a formidable challenge. The country will need substantial investment to boost oil production, which faces declining global demand. Venezuela’s economic landscape has shifted dramatically since the early 2000s when oil production was at its peak. The country’s output has fallen from 3.5 million barrels per day to less than one million, contributing to a 70% drop in GDP since 2013.

Under both Hugo Chávez and Nicolás Maduro, Venezuela’s governments relied heavily on oil revenues to fund social programs, neglecting the need to invest in maintaining and expanding oil production. This short-sighted approach, coupled with US sanctions, has contributed to the current economic malaise. The situation worsened after Chávez’s death in 2013, with Maduro’s tenure seeing further decline in oil production and rampant inflation.

The economic hardships have led to a mass exodus of over 7.7 million Venezuelans seeking better opportunities abroad. For those remaining, the informal dollarization of the economy has provided some stability, though it has also created a stark divide. Caracas, the capital, now experiences a two-tier economy where those using US dollars enjoy better access to goods and services, while those relying on bolívars face increasing economic exclusion.

The recent performance of Colombian reggaeton star Karol G in Caracas, where she sold out two nights at the Estadio Monumental despite high ticket prices, underscores this divide. While the entertainment sector continues to attract international talent, most Venezuelans struggle with low wages and limited purchasing power.

Venezuela’s foreign debt, estimated at $150 billion, remains a significant challenge. The country has been in partial default since 2017, with no progress on debt restructuring talks. The situation is complicated by bonds issued by PDVSA using Citgo as collateral, leading to legal actions in the US.

Bruno Gennari, Emerging Markets Strategist at KNG Securities, points out that Venezuela’s legitimacy crisis—exacerbated by the lack of international recognition of Maduro’s presidency—complicates potential debt restructuring. Although there is a possibility that the US might overlook Maduro’s contested election, Gennari suggests that such an outcome is unlikely.

The upcoming election could determine whether Venezuela begins a complex recovery process or continues its struggle. Once the richest country in South America, Venezuela’s path to stability remains uncertain, with its economic glory days seemingly a distant memory.