U.S. Economic Growth Accelerates to Strong 2.8% Annual Rate in Second Quarter Despite High Interest Rates

Fiona Nanna, ForeMedia News

2 minutes read. Updated 3:00AM GMT Thurs, 25July, 2024

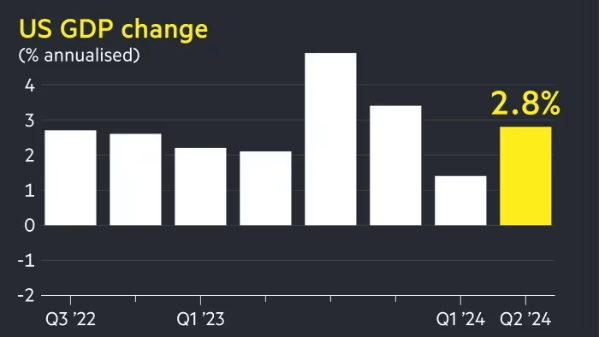

The U.S. economy demonstrated significant resilience in the last quarter, with an impressive acceleration to a 2.8% annual growth rate. This robust expansion, reported by the Commerce Department, reflects the nation’s economic vitality despite the persistent challenge of high interest rates.

The latest report highlights that the gross domestic product (GDP), which measures the total output of goods and services, experienced a notable increase in the April-June quarter. This marks a considerable improvement from the 1.4% growth rate observed in the January-March period. The surge in economic activity exceeded economists’ expectations, who had predicted a more modest 1.9% annual growth rate.

Inflation trends, while still above the Federal Reserve’s 2% target, showed signs of moderation. The central bank’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) price index, rose at a 2.6% annual rate during the second quarter, a decrease from the 3.4% rate recorded in the first quarter of the year. Core PCE inflation, which excludes volatile food and energy prices, increased at a 2.9% pace, down from 3.7% in the previous quarter.

This positive economic data provides a strong signal that the U.S. economy may be nearing a rare “soft landing.” This term refers to the Federal Reserve’s strategy of using high interest rates to control inflation while avoiding a recession. The current figures bolster confidence that the central bank’s approach is on track to achieve this delicate balance.

Read more about the latest economic trends