Warren Buffett’s Berkshire Hathaway Surpasses $1 Trillion Market Value, Joins Apple, Microsoft, Amazon, and Others in Elite Trillion-Dollar Club

Fiona Nanna, ForeMedia News

6 minutes read. Updated 7:01PM GMT Wed, 28August, 2024

In a remarkable achievement, Warren Buffett’s conglomerate, Berkshire Hathaway (BRKa.N), has crossed the $1 trillion market valuation mark on Wednesday, signaling a high level of investor confidence in the sprawling business empire Buffett has meticulously built over nearly six decades. This milestone not only cements Berkshire Hathaway’s position as one of the most influential players in the American economy but also aligns it with an exclusive club of companies that have achieved such a valuation.

Berkshire Hathaway Joins Trillion-Dollar Club

Berkshire Hathaway is now among six other companies, primarily from the tech sector, that boast a market capitalization exceeding $1 trillion: Apple (AAPL.O), Nvidia (NVDA.O), Microsoft (MSFT.O), Google parent Alphabet (GOOGL.O), Amazon.com (AMZN.O), and Facebook parent Meta Platforms (META.O). This achievement reflects Berkshire’s diversified portfolio and its resilient business model, which many investors consider a proxy for the U.S. economy.

The company’s valuation is calculated based on its outstanding 553,234 Class A shares and 1,325,192,508 Class B shares as of July 23. Notably, Berkshire Hathaway has slowed down its stock repurchase activities this year, signaling a strategic shift in capital management under Buffett’s guidance.

Solid Financial Performance Boosts Investor Confidence

During morning trading on Wednesday, Berkshire Hathaway’s Class A shares experienced a 0.7% increase, reaching $696,005.94. This surge is part of a broader upward trend fueled by strong financial performance across its diverse business segments. The conglomerate’s extensive portfolio includes well-known brands such as Geico car insurance, BNSF railroad, Berkshire Hathaway Energy, Brooks running shoes, Dairy Queen ice cream, Ginsu knives, and World Book encyclopedia, among others.

For the first half of the year, Berkshire’s insurance, energy, manufacturing, retail, and service sectors collectively generated a profit of $22.8 billion, representing a 26% increase compared to the previous year. This solid performance highlights Berkshire Hathaway’s ability to weather economic challenges and thrive amidst market fluctuations.

Strategic Stock Sales and Cash Reserves

Despite its solid portfolio, Berkshire Hathaway has been strategically divesting some of its holdings, particularly in Apple, the crown jewel of its stock investments. This year alone, the company has sold more than half of its Apple shares. These stock sales have contributed to a significant increase in Berkshire’s cash reserves, which soared to $276.9 billion as of June 30, primarily held in U.S. Treasury bills. This substantial cash position provides Berkshire with flexibility for future investments and acquisitions.

Buffett’s Legacy and Unmatched Returns

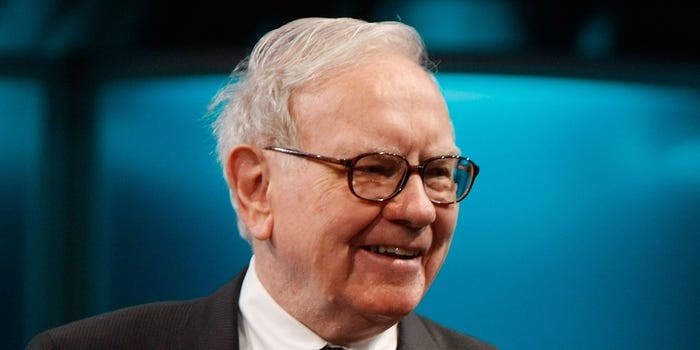

As Berkshire Hathaway celebrates this monumental achievement, it also underscores the unparalleled legacy of its leader, Warren Buffett, who will turn 94 on August 30. Buffett has been at the helm of Berkshire since 1965, and under his leadership, the company has transformed into a titan of American industry. Since Buffett took over, Berkshire’s shares have skyrocketed by more than 5,600,000%, equating to an impressive annual return of about 20%. This is nearly double the annualized gain of the Standard & Poor’s 500 (.SPX), including dividends.

Despite his extensive charitable donations—having given away more than half of his shares to charity since 2006—Buffett still owns over 14% of Berkshire Hathaway. As of Tuesday, his fortune was estimated to be around $144.9 billion, positioning him as the sixth-richest person globally, according to Forbes.

Market Performance and Future Outlook

Berkshire Hathaway shares have climbed 27% this year, outperforming the S&P 500’s 18% gain. This robust performance reflects the conglomerate’s strategic decisions, diversified investments, and resilient business operations, which continue to attract investors worldwide. As Berkshire enters this new chapter, the focus will likely remain on value creation, prudent investment strategies, and sustainable growth.

Berkshire Hathaway’s achievement of a $1 trillion market cap not only celebrates the conglomerate’s historic success but also reflects Warren Buffett’s vision and leadership. With a legacy built on long-term value investing, Berkshire Hathaway remains a significant force in the global financial landscape.