Mainland China’s CSI 300 Index Surges 8.5% in Biggest Rally Since 2008, Driven by Government Stimulus, While Japan’s Nikkei 225 Plunges 4.8% Amid Weak Economic Data

Fiona Nanna, ForeMedia News

6 minutes read. Updated 10:04AM GMT Sun, 29 September, 2024

Mainland China’s stock market experienced an extraordinary surge on Monday, closing out its best day in 16 years. The CSI 300 index, representing major companies on the Shanghai and Shenzhen exchanges, leaped 8.48%, reaching 4,017.85, its highest level since August 2023. Meanwhile, Japan’s Nikkei 225 tumbled 4.8%, highlighting stark contrasts between the two major Asian economies. Investors were closely analyzing economic data, revealing optimism in China amid worrying declines in Japan.

China’s Stocks Surge Amid Optimism

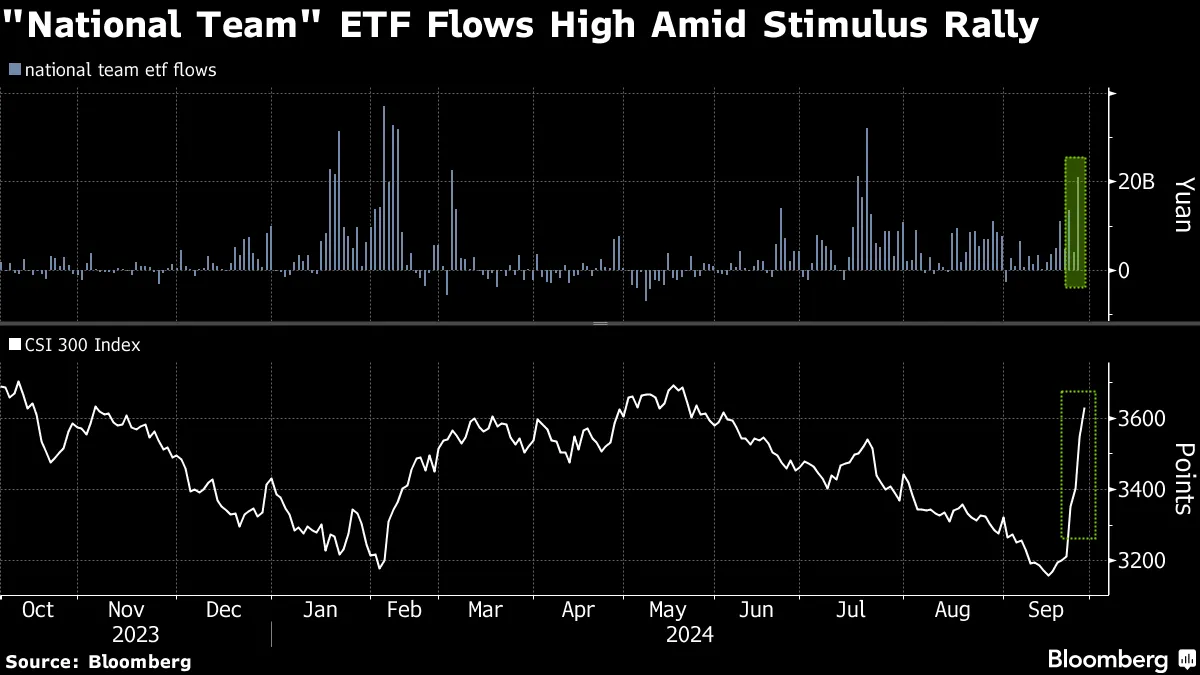

The rally in China’s CSI 300 was mainly driven by gains in health-care and tech sectors, which contributed to an impressive nine-day winning streak, culminating in the largest single-day percentage increase since September 2008. The rebound is partly attributed to market enthusiasm over recent stimulus measures introduced by the Chinese government to stabilize its economy. This surge follows a challenging year for China’s market, where global investor sentiment had been affected by slowed growth and concerns around regulatory crackdowns.

China’s official Purchasing Managers’ Index (PMI) for September was reported at 49.8, which, while below the threshold for expansion (50), beat the expectation of 49.5 from a Reuters poll. This marked the fifth consecutive month of contraction in China’s manufacturing sector, but the better-than-expected data provided enough encouragement for investors to regain confidence in Chinese markets.

The private Caixin PMI survey, compiled by S&P Global, painted a less optimistic picture. It indicated a fall in the manufacturing PMI to 49.3 in September from 50.4 in August, which was lower than economists’ prediction of 50.5. The decline, described as the fastest in 14 months, highlights the challenges faced by China’s private sector, even amid broad stimulus efforts.

Hang Seng Index Joins the Surge

Hong Kong’s Hang Seng Index also joined the rally, gaining 3.09% by its final hour of trading, buoyed by consumer stocks. The Hang Seng Mainland Properties Index performed exceptionally well, soaring 8.11%, which suggests that the Chinese property sector—long seen as a significant concern for the nation’s economic stability—may finally be showing signs of recovery. However, this could be temporary, with further data needed to determine if the sector is indeed on a sustainable path to improvement.

Related Article: The Impact of Chinese Property Market Fluctuations

Japan’s Market Under Pressure

While mainland China celebrated a day of gains, Japan’s financial markets faced severe setbacks. The Nikkei 225 ended at 37,919.55, with real estate stocks leading the declines. The largest individual loser on the Nikkei was Isetan Mitsukoshi Holdings, a department store chain, which fell by 10.64%. The Topix index also witnessed significant losses, falling 3.47% to close at 2,645.94.

This decline comes amid discouraging economic data from Japan. Industrial production in August dropped 4.9% year-on-year, a substantial fall compared to July’s decline of 0.4%. On a month-on-month basis, production decreased by 3.3%, worse than the expected 0.9% drop, reflecting ongoing challenges in Japan’s manufacturing sector.

The Japanese yen also weakened against the U.S. dollar, trading at 142.38, indicating investor concerns about the country’s growth prospects. However, there was some positive news for the Japanese economy: retail sales increased by 2.8% in August compared to the previous year, slightly better than the anticipated 2.3% growth. This was a marginal improvement over the revised 2.7% growth recorded in July.

Political Changes Affect Market Sentiment

Investor sentiment was further influenced by recent political developments in Japan. Shigeru Ishiba’s victory in the Liberal Democratic Party elections signals a leadership change, with Ishiba set to succeed Fumio Kishida as Japan’s new Prime Minister. While Ishiba is expected to continue the existing monetary policies, there remains some market uncertainty over how he will navigate Japan’s ongoing economic challenges.

U.S. Markets React to Economic Data

In contrast, U.S. markets saw a more muted response in overnight trading. The Dow Jones Industrial Average rose by 0.33%, ending at 42,313.00, as traders responded to new data that showed promising signs in the Federal Reserve’s battle against inflation. The S&P 500, however, dipped by 0.13%, while the Nasdaq Composite lost 0.39%.

Recent U.S. inflation data revealed a 0.1% increase in the personal consumption expenditures price index for August, matching analysts’ expectations. Investors are optimistic that this indicates progress in curbing inflation, which could influence the Federal Reserve’s future interest rate decisions.

Monday’s market moves highlight the diverging economic paths of China and Japan. As China experiences renewed optimism fueled by government stimulus and positive PMI figures, Japan grapples with concerning declines in production and shifts in political leadership. Global investors continue to monitor these key Asian economies, especially as further policy changes and economic data emerge.

Meta Description: Mainland China’s stocks surged over 8%, marking the best trading day since 2008, while Japan’s Nikkei 225 faced sharp declines amid mixed economic data. Read more about the stimulus rally and economic outlook in Asia.